Financial Review

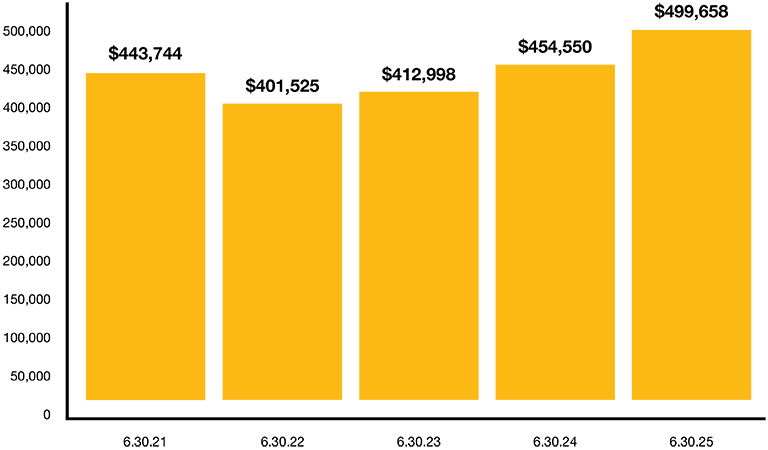

Harvey Mudd maintained a strong financial position while navigating an ever-changing and complex economic and political environment, including rising costs and new federal regulations. Through our continued partnership with the Claremont Investment Fund, the College’s endowment has reached its highest level to date, reinforcing our ability to deliver positive financial outcomes. This year, the College launched the Innovation Accelerator to advance our strategic plan, STEM for a Better World. Designed to foster bold, collaborative proposals that drive institutional impact, the initiative reflects our commitment to innovation and long-term priorities. As we look ahead, the College remains committed to prudent resource management while investing in initiatives that support academic excellence, innovation, and sustainable growth.

Endowment Market Value

(In thousands)

$500 Million

JUNE 30, 2025

Statement of Activities

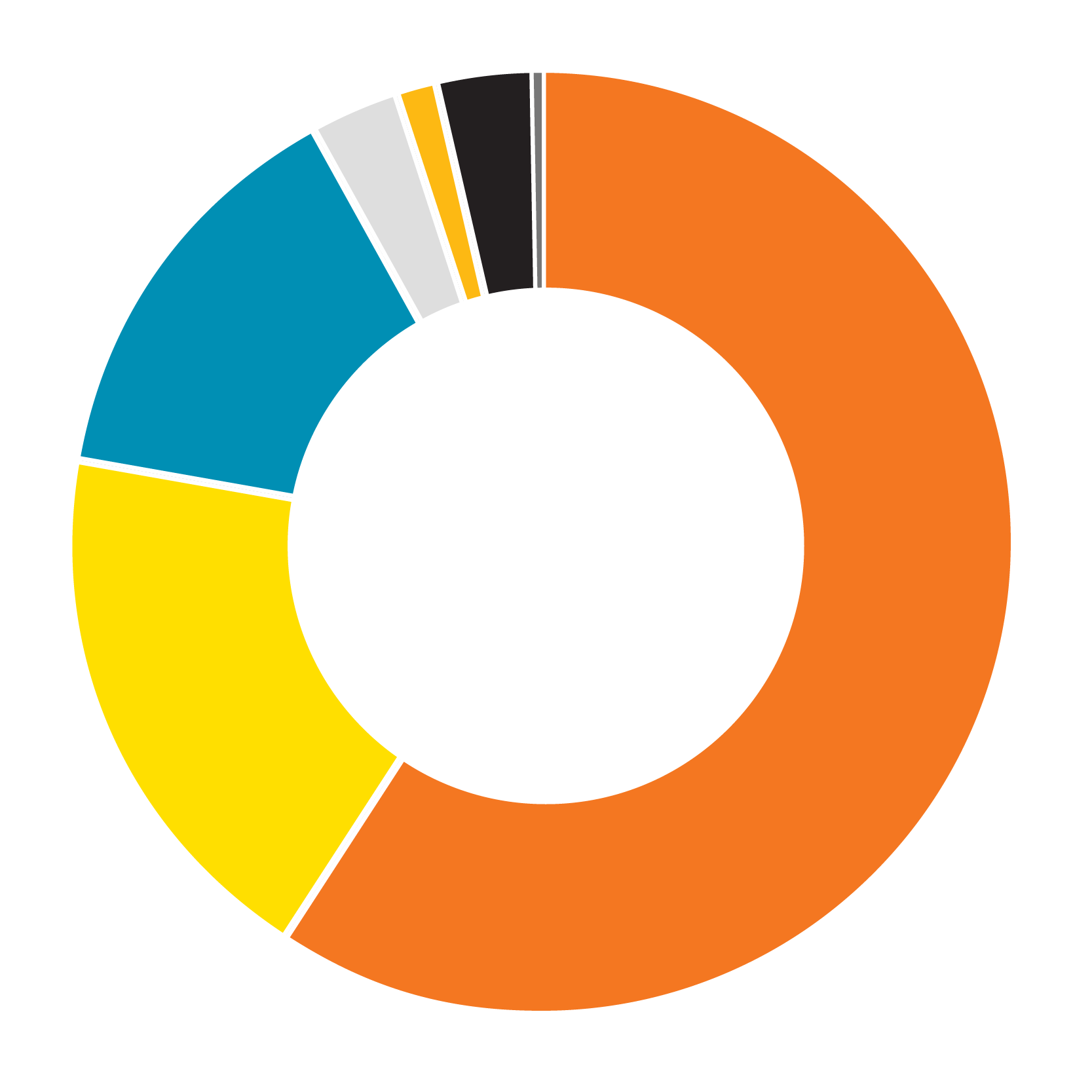

Revenue

| Category | 2025 | 2024 |

|---|---|---|

| Tuition, fees, room and board | $81,053 | $78,127 |

| Less financial aid | ($22,823) | ($22,451) |

| Net student revenues | $58,230 | $55,676 |

| Federal grants | $2,851 | $4,565 |

| Private gifts and grants | $13,774 | $12,487 |

| Private contracts | $1,519 | $1,639 |

| Contribution of non-financial assets | $103 | $0 |

| Endowment payout | $18,235 | $17,531 |

| Other revenue | $3,278 | $3,437 |

| Total Revenue | $97,990 | $95,335 |

- Net student revenues, 59.4%

- Endowment payout, 18.6%

- Private gifts and grants, 14.1%

- Federal grants, 2.9%

- Private contracts, 1.6%

- Contribution of non-financial assets, 0%

- Other revenue, 3.3%

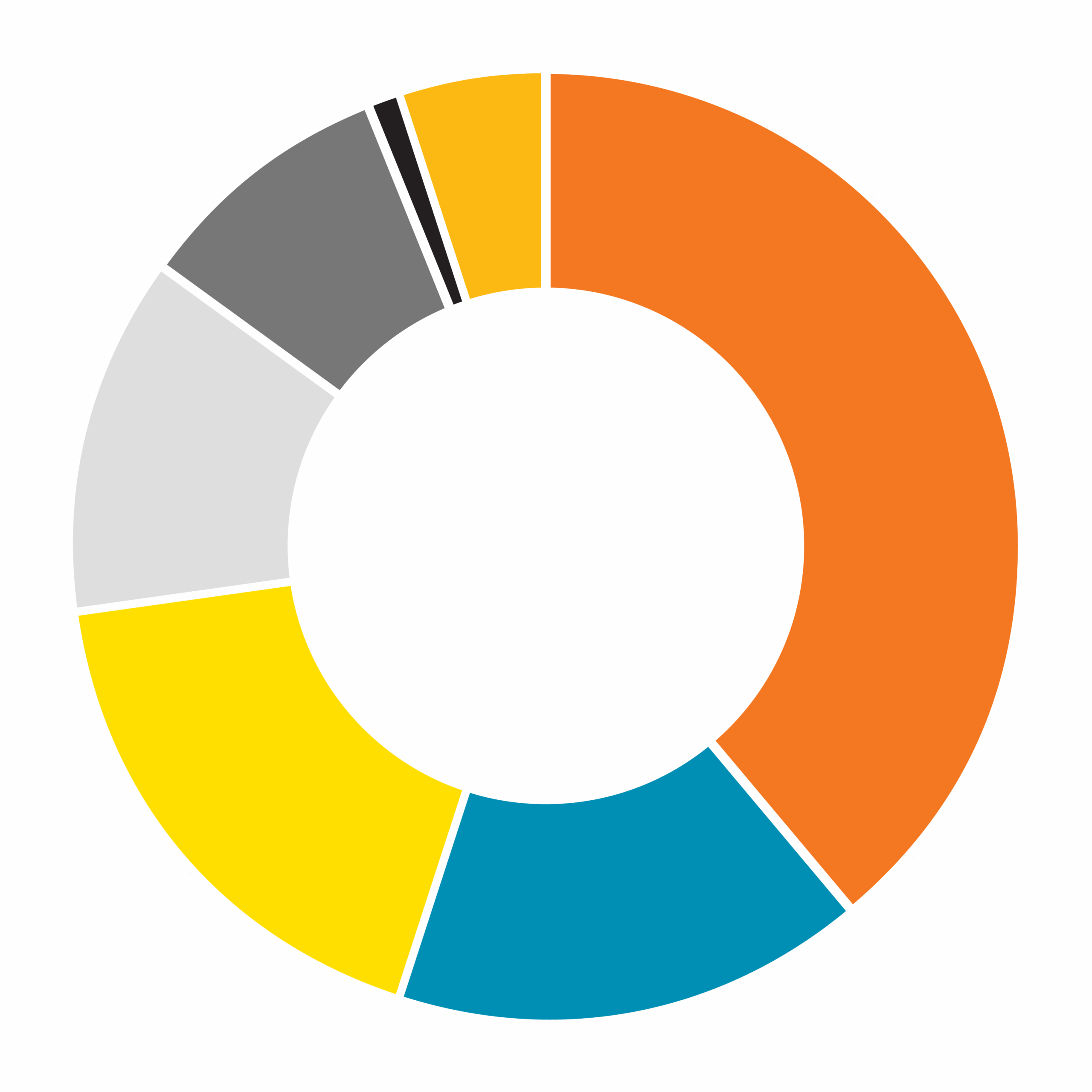

Expenses

| Category | 2025 | 2024 |

|---|---|---|

| Instruction | $35,672 | $34,548 |

| Research | $4,769 | $4,627 |

| Public service | $924 | $855 |

| Academic support | $8,298 | $7,914 |

| Students services | $10,935 | $10,008 |

| Institutional support | $16,593 | $15,369 |

| Auxiliary enterprises | $13,969 | $13,352 |

| Total Expenses | $91,160 | $86,673 |

| Total Expenses | $91,160 | $86,673 |

|---|---|---|

| Excess revenue over expenses | $6,830 | $8,662 |

| Pooled investment gains (losses), net of endowment payout | $38,226 | $33,336 |

| Other changes in net assets | ($531) | ($131) |

| Change in net assets | $44,525 | $41,867 |

- Instruction, 39.1%

- Institutional support, 18.2%

- Auxiliary enterprises, 15.3%

- Student services, 12.0%

- Research, 5.2%

- Academic support, 9.1%

- Public service, 1.0%